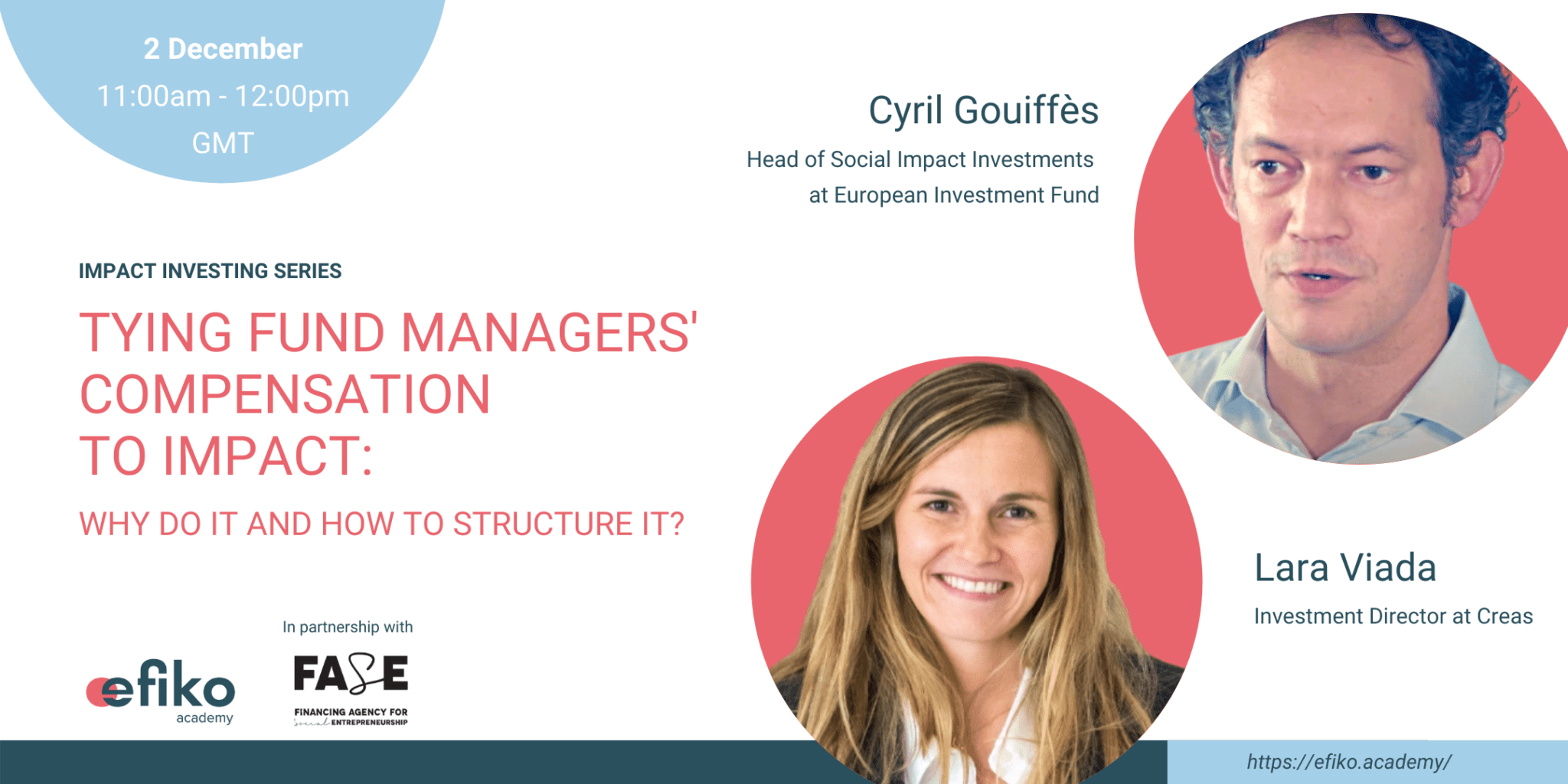

Tying fund managers' compensation to impact: why do it and how to structure it. Hosted by the Efiko Academy and FASE.

In mainstream investing, success is measured through financial performance – returns. To align fund managers’ interests, their carry is tied to it. If impact investing promises both financial and impact performance, should we link compensation accordingly?

This one-hour podcast with industry experts and practitioners allows you to discover the advantages and challenges of impact-based incentives and how some impact funds structure them. On this topic, we warmly welcome:

- Cyril Gouiffès, Head of Social Impact Investments at the European Investment Fund

- Lara Viada, Investment Director at Creas

Moderated by Laura Catana from FASE, we discuss why it may or may not make sense to embed impact into compensation packages, what the options are to do it and how they can be used to penalise or rather reward fund managers.

Feeling curious? Listen to the podcast below and check out our course brought to you in collaboration with FASE. Entitled ‘Innovative Impact Deal Structuring’, you will learn how to use financial tools and structures to scale ventures and maximise their social impact. Read more here.