If you are immersing yourself in sustainability reporting and impact management, you will have come across many hard-to-pronounce acronyms such as CSRD, GRI, ISSB, and SROI. Behind each one of these acronyms is a resource that in most cases is complementary to others and can help you advance your practice.

In this piece, we provide four keys to identify the differences and complementarities between impact management standards. These keys are Function, Perspective on Materiality, Thematic Focus, and Target Audience. We’d like to invite you to discover them by watching the video below or reading the summary.

The Function of Sustainability Standards

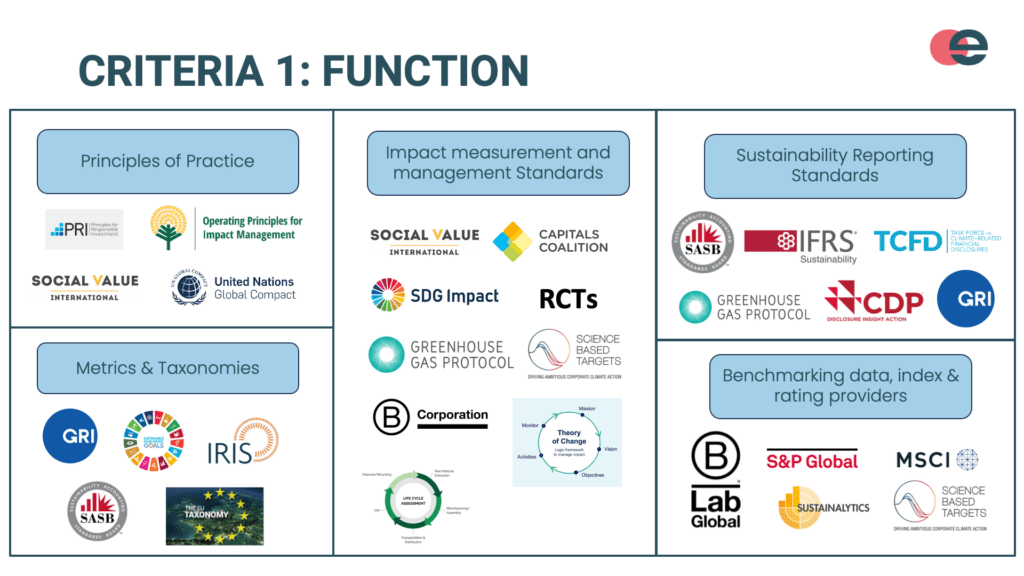

Understanding the roles and relationships among key principles, standards, and taxonomies is crucial to identifying complementarities and differences. It also helps to shed light on the inherent ‘hierarchy’ between the popular standards. The five most common functions are:

- Overarching Principles of Practice

- Measurement and management standards

- Reporting Standards

- Metrics & Taxonomies

- Rating and benchmarking.

Principles of Practice provide the ethical foundation underpinning actionable Measurement and Reporting Standards. These standards, in turn, guide the creation of essential Metrics and Taxonomies, ultimately leading to the data produced by Rating and Benchmarking providers, which is crucial for assessing and comparing sustainability performance. To provide an example, Operating Principles of Impact Management (principles) underpin the development of the SDG Impact Standards (impact management function) which in turn informs the GRI (a reporting standard) and IRIS+ (a metrics provider).

The Perspective on Materiality

The ongoing debate between ESG and Impact management advocates centres on the definition of what types of impacts an organisation should actively manage and report. This debate revolves around two key perspectives: Financial Materiality, often referred to as Single Materiality, and Stakeholder Materiality, also known as Double Materiality. Financial Materiality emphasises factors directly affecting a company’s financial performance, while Stakeholder Materiality takes into account broader societal and environmental impacts that may not immediately translate into financial outcomes.

This tension between the two perspectives reflects a fundamental question in sustainability reporting and management – whether a company’s responsibilities should primarily (or exclusively) align with shareholder value or integrate a wider range of stakeholders and societal concerns. Examples of financial materiality standards are IFRS S2 issued by the ISSB or the Principles of Responsible Investment (PRI). Double materiality standards include the ESRS norms underpinning the European Corporate Sustainability Reporting Directive (CSRD).

Want to Learn About the Two Final Keys and More?

If you appreciated the reading so far and would like to learn about impact management and sustainability reporting standards, make sure to check out our free trial on Impact measurement Fundamentals as well as other courses introduced in our training catalogue.

Do not hesitate to share any comments you may have about this piece or reach out to us for any feedback, questions or additional guidance (support@efiko.academy).

These courses might interest you

Impact Measurement: Applying the Principles of Social Value and SROI

Designing a Robust Theory of Change